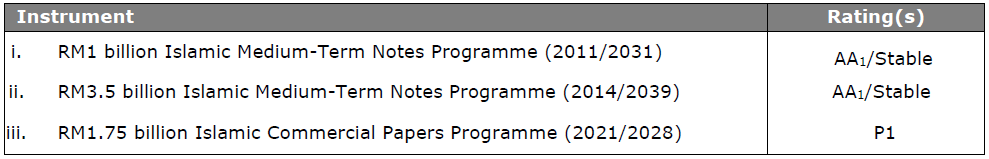

[RAM] RAM Ratings affirms Sabah Credit Corporation's AA1/Stable/P1 sukuk ratings

RAM Ratings has affirmed the AA1/Stable/P1 ratings of Sabah Credit Corporation’s (SCC or the Corporation) sukuk programmes (Table 1).

The ratings benefit from an uplift, reflecting our assessment of expectation of ready financial support from the Sabah state government – which wholly owns the Corporation – should it be required. Support is evidenced by the subordination of SCC’s state borrowings to its debt securities and the conversion of some of these borrowings into share capital.

The affirmation also reflects the Corporation’s standalone risk profile, underscored by its healthy profitability, comfortable gearing level and well-controlled asset quality risks. About 98% of SCC’s RM3 bil financing base comprises personal financing (PF) facilities extended to civil servants, most of which are repaid through non-discretionary salary deductions made by the Services Bureau of the national apex cooperative, Angkasa, and the Sabah State Treasury. This, coupled with the low attrition rate in the civil service, alleviates risks arising from the customers’ capacity and willingness to pay.

As at end-December 2023, SCC’s overall gross impaired financing (GIF) ratio eased to 2.2% (end-December 2022: 2.5%), thanks to lower accretion of GIF and still sizeable write-offs of impaired PF. As a state-owned entity, SCC’s write-offs are slower compared to peers due to bureaucratic policies. Excluding impaired PF facilities that are 12 months or more in arrears and those impaired pursuant to the three-month moratorium granted in 2020 (for which repayments have resumed), the adjusted GIF ratio would have been a lower 1.5% (end-December 2022: 1.7% on adjusted basis). Overall, the Corporation’s loss absorption buffer stayed robust, with GIF coverage of 138%.

Potential refinancing risk from SCC’s dependence on market-based wholesale funding is mitigated by expected state funding and liquidity support if necessary. In FY Dec 2023, pre-tax profit rose 4.6% y-o-y to RM107 mil, mainly attributed to lower net impairment charges, partly offset by higher operating expenses. Growth in retained earnings, in turn, led to improved gearing of 2.5 times as at end-December 2023 (end-December 2022: 2.7 times). Looking ahead, we anticipate profitability to remain healthy despite increased digitalisation expenses and the refinancing of maturing sukuk at higher rates.

Analytical contacts

Liew Kar Ling

(603) 3385 2586

karling@ram.com.my

Jeremy Noel Paul

(603) 3385 2556

jeremynp@ram.com.my

Media contact

Sakinah Arifin

(603) 3385 2500

sakinah@ram.com.my