Asian Bond Pricing Forum 2025

21 October, 2025

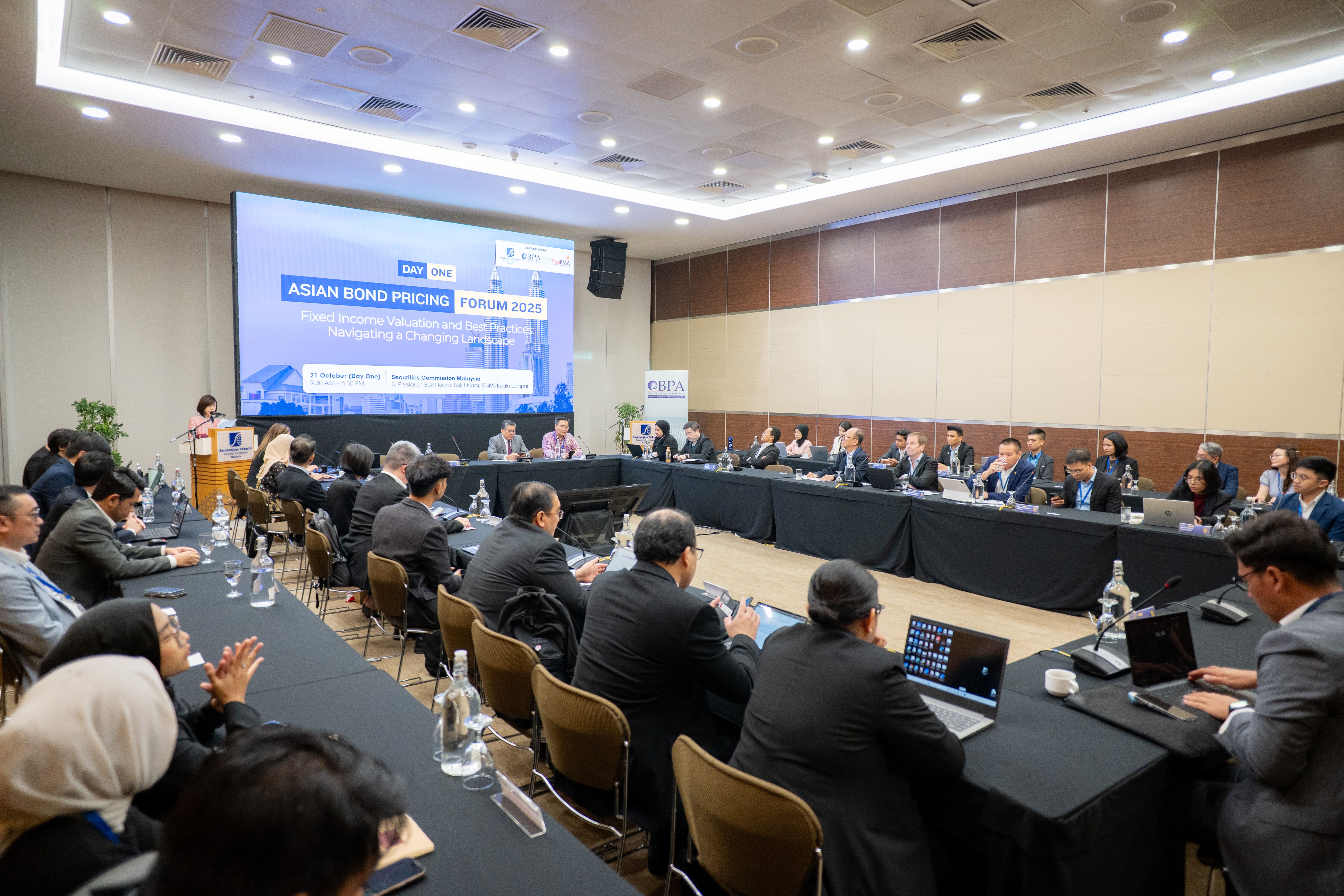

On 21–22 October 2025, the Securities Commission Malaysia (SC), Bond Pricing Agency Malaysia (BPAM) and The Thai Bond Market Association (ThaiBMA), co-organised the Asian Bond Pricing Forum 2025, held at the Securities Commission Malaysia. Officiated by YBhg. Dato’ Zain Azhari Mazlan, Executive Director of Corporate Finance & Investments at the SC, the event brought together regulators, industry leaders, and market practitioners from across ASEAN to discuss developments in the region’s fixed income markets, share practical insights, and explore new approaches to enhance transparency and efficiency.

Day One opened with a presentation by Nurul Ashikin Abd Rahim (SC), who shared updates on Malaysia’s bond and sukuk market development and the SC’s initiatives in sustainability and digitalisation, followed by Muhammad Akram Ramli (BIX Malaysia), who highlighted BIX’s role in enhancing transparency and accessibility. Subsequent country presentations by Djoko Saptono (PHEI, Indonesia), Hew Sue Ling (BPAM, Malaysia), Luis Gabriel Señires (Bureau of the Treasury, Philippines), Sirinart Amornthum (ThaiBMA, Thailand), and Vương Thanh Long (VBMA, Vietnam) provided regional insights into bond market developments and valuation practices. In the afternoon, discussions shifted toward cost management, revenue diversification, and retail bond market development. Hew Sue Ling (BPAM) presented BPAM’s approach to expanding valuation coverage to new asset classes, followed by a panel exploring strategies to manage costs while maintaining valuation integrity. The session continued with Ng Keng Sing (Bursa Malaysia RAM Capital), who introduced BR Capital’s initiative to democratise fixed income investing for mid-tier markets, and Chaitat Prachuabdee (ThaiBMA), who shared Thailand’s experience in expanding retail bond market access through digital innovation.

Day Two began with the theme of sustainability, focusing on regional differences in ESG principles and market mechanisms. Speakers such as Arshad Nuval Othman (CIMB Islamic Bank), Gladys Chua (RAM Sustainability), Leslie Jong Vui Min (MARC Solutions), and Tan Jack Fong (SC) shared their perspectives on ESG integration and the growing importance of sustainable finance in the bond market. This was followed by Selvarany Rasiah (Kapital DX), who discussed the use of tokenisation and digital platforms in expanding market accessibility. Later sessions featured Haza Rina Borhan and Audrey Chai (BPAM), who spoke on partnership integrity and collaboration in supporting transparent valuation practices, while Leong See Meng (Bursa Malaysia) and Noor Bazlina Sharifmuddin (BPAM) concluded the forum with discussions on index harmonisation and the development of regional benchmarks.

The Asian Bond Pricing Forum 2025 underscored the importance of collaboration and transparency in developing Asia’s bond markets. The discussions and insights shared will continue to guide efforts toward a more efficient and connected regional fixed income ecosystem.